Table of Contents

The Birth of FTUK: How It All Began

FTUK, or Forex Traders UK, is an innovative London-based proprietary trading firm that was established in February 2021. The company is dedicated to enhancing the proprietary trading landscape and delivering superior services to successful forex traders worldwide. FTUK offers a range of funding programs, including instant funding, enabling traders to access live capital and commence trading with the firm’s resources from day one. Notably, FTUK provides fully funded accounts, zero loss liability, and transparent pricing with no hidden fees.

Over the past two years, FTUK has extended its support to more than 15,000 traders in 130 different countries. Their core mission is to provide aspiring traders with an opportunity to achieve success without the burden of accumulating debt. FTUK achieves this by offering a streamlined one-step evaluation challenge, affordable pricing for live accounts, and two distinct package categories tailored to cater to both novice and seasoned traders.

Moreover, FTUK is committed to educating traders through valuable resources available on their website, such as informative blog posts covering a wide range of topics, including trader psychology, technical strategies, and insightful interviews with experienced traders.

Exploring the Key Features of FTUK

FTUK offers a range of notable features, including:

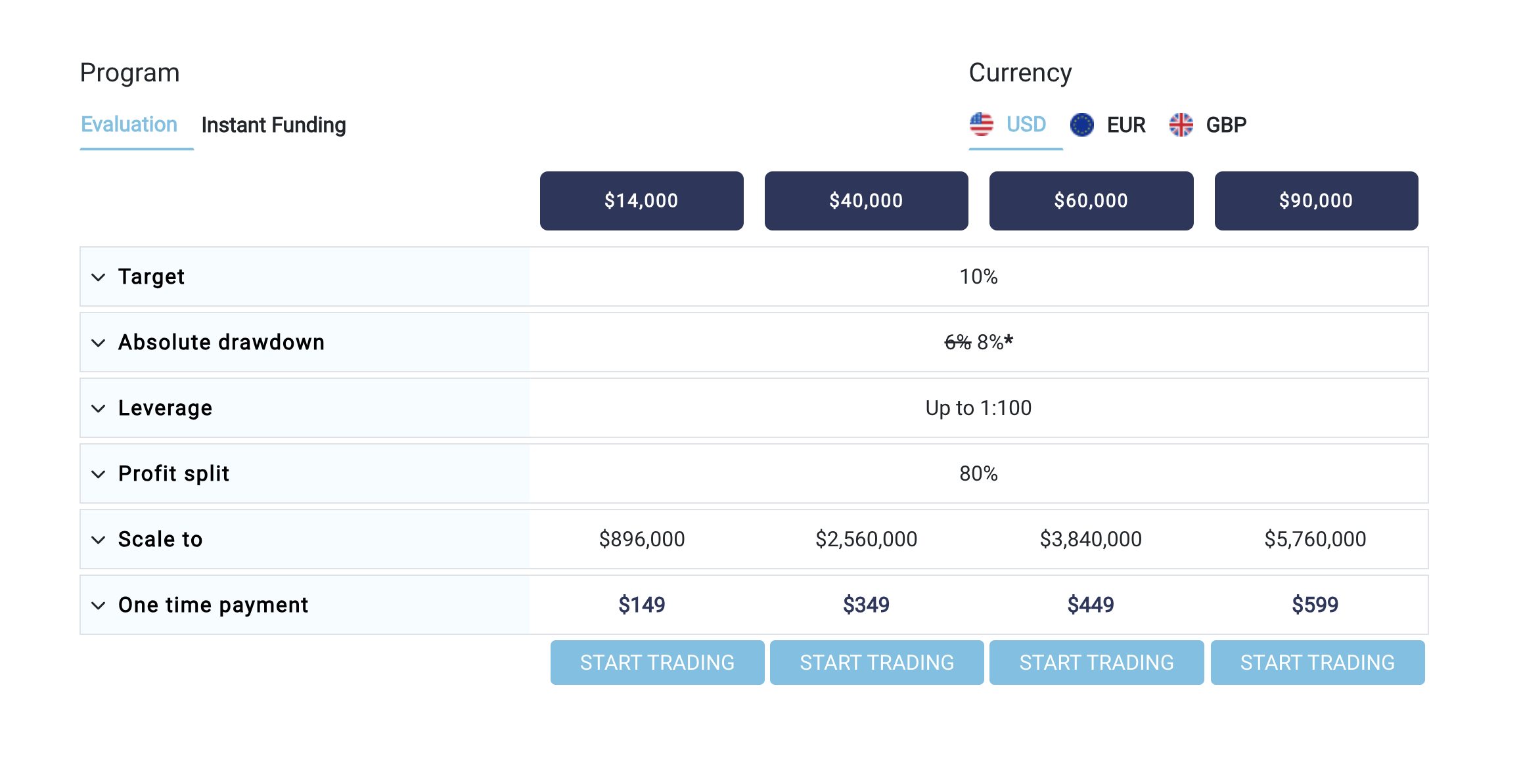

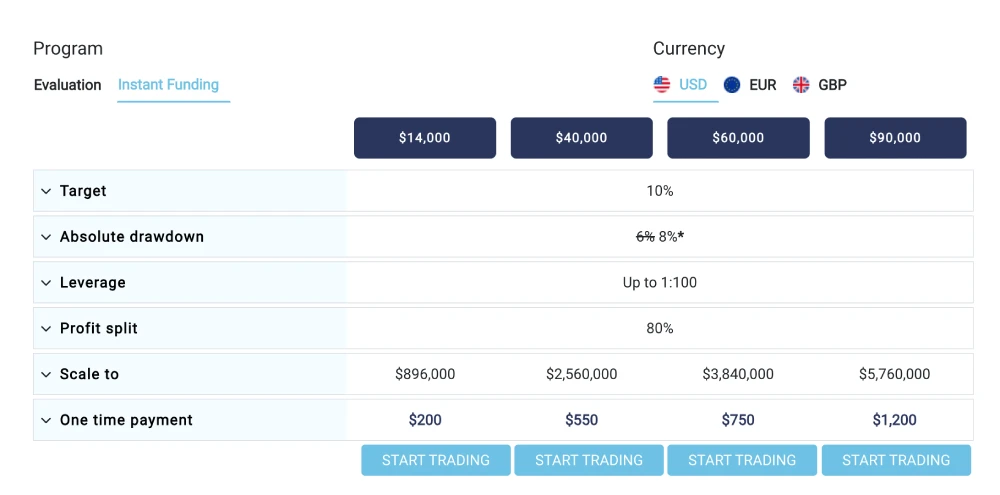

- Instant Funding and One-Step Evaluation: FTUK presents traders with two primary funding programs, Instant Funding and the One-Step Evaluation. Instant Funding grants traders access to live funds without the need for an evaluation process, while the One-Step Evaluation program simplifies the evaluation phase into a single step, allowing traders to demonstrate their ability to manage substantial capital effortlessly.

- Scalable Funding Opportunities: FTUK empowers traders to scale their funded accounts up to $5,760,000. This feature enables exceptional traders to effectively manage larger capital and advance their trading careers.

- Profit Sharing: FTUK offers an attractive 80% profit split for traders, ensuring they retain a significant portion of their trading profits.

- Trading Flexibility: The firm provides traders with the flexibility to engage in a diverse range of financial instruments, including forex, indices, commodities, and metals. FTUK also permits various trading strategies, including news trading, overnight and weekend trading, and the utilization of expert advisors (EAs) or robots.

- Educational Resources: FTUK offers valuable educational content through their website’s blog posts, covering a wide array of topics such as general trading principles, the psychology of traders, technical strategies, and engaging trader interviews. Furthermore, they extend personalized mentorship, pairing traders with experienced mentors who provide guidance and support.

- Support: FTUK ensures round-the-clock assistance by providing access to 24/7 trade support specialists via email, ensuring traders have the necessary support whenever they require it.

Uncovering the Pros and Cons of FTUK

Positive Aspects of FTUK:

- Diverse Funding Options: FTUK provides traders with two primary funding programs – Instant Funding and the One-Step Evaluation. Instant Funding allows traders to access live funds without undergoing an evaluation process, while the One-Step Evaluation program streamlines the evaluation into a single phase, where traders can demonstrate their ability to manage substantial capital effectively.

- Scalable Funding Opportunities: FTUK enables traders to scale their funded accounts up to an impressive $5,760,000. This feature empowers exceptional traders to handle larger capital, facilitating the growth of their trading careers.

- Generous Profit Sharing: FTUK offers an attractive 80% profit split for traders, ensuring they retain a significant portion of their trading profits.

- Flexible Trading: The firm provides traders with flexibility by offering various financial instruments, including forex, indices, commodities, and metals. Additionally, FTUK allows for news trading, overnight and weekend trading, and the utilization of expert advisors (EAs) or robots.

- Educational Resources and Mentorship: FTUK enriches traders’ knowledge with educational content available through blog posts on their website, covering a wide range of topics, including general trading principles, the psychology of traders, technical strategies, and insightful trader interviews. They also offer personalized mentorship, pairing traders with experienced mentors who provide valuable guidance and support.

- Accessible Support: FTUK ensures traders have access to 24/7 trade support specialists via email, ensuring assistance is available at any time.

Cons of FTUK:

- Limited Funding Steps: FTUK offers funding in specific, non-standard amounts, with steps of $14,000, $40,000, $60,000, or $90,000, potentially limiting options for traders.

- Limited Platform Options: Trading with FTUK is exclusively conducted through MetaTrader platforms, and alternative platforms are not available.

- Strict Drawdown Rules: FTUK enforces a maximum drawdown of 5% of the balance, which is relatively low. This requires careful monitoring of trades, as inefficient trading may result in automatic closure of positions and account suspension.

- Profit-Sharing Ratio: The initial profit-sharing ratio starts at 50%, which may be considered relatively lower when compared to other firms.

- Leverage Concerns: Some traders might find the leverage offered by FTUK less optimal.

- Low Leverage: FTUK provides low leverage options of 10:1 and 30:1, which could be a disadvantage for traders seeking higher leverage opportunities.

Challenges in Pricing

Payout certificate

Conclusion

Overall, FTUK appears to cater to a wide range of traders, offering accessible funding options, educational support, and a generous profit-sharing scheme. However, traders should be aware of the limitations, such as strict drawdown rules and limited platform choices, when considering FTUK as their trading partner.

Risk Warning: It’s essential to remember that trading involves risk, and the content on the ProdanAdvisor website is for general information only. The service and company website are provided on an “as-is” basis and without warranty of any kind.