Table of Contents

Introduction to CFD Prop Trading

In the world of financial markets, Contracts for Difference (CFD) prop trading holds a significant position. These trading firms allow investors to speculate on financial markets like forex, indices, shares, and commodities without owning the underlying asset. Now, let’s delve into the top 10 firms in CFD prop trading.

FTMO, a renowned name in the CFD proprietary trading circle, is a firm that provides a viable platform for skilled traders to effectively manage capital and optimize profits. The brainchild of Otakar Suffner, FTMO was established in 2015 and since then, it has been carving a niche for itself in the industry by emphasizing transparency, accessibility, and profitability.

FTMO is under the steady leadership of its CEO, Otakar Suffner. His expertise and strategic vision have contributed significantly to FTMO’s success in creating a thriving trading platform.

The firm offers a robust funding program that allows traders to get access to up to $100,000 for a one-time fee, which is returned after meeting the initial profit target. They emphasize fair evaluation, with traders having to pass a 2-step verification process before gaining unrestricted access to the capital. FTMO also offers a profit split of 80% to the trader and 20% to the firm, which is considered to be quite competitive in the current market scenario. This structure ensures that the more profits you make, the greater your share becomes.

Besides empowering traders with capital, FTMO has some quite unique offerings. Their proprietary ‘FTMO App’ brings in mobility, allowing traders to keep tabs on their performance, access educational content, account analysis, and more, right at their fingertips. FTMO has also developed a series of proprietary tools to aid its traders, including Psychologica – a stress management tool, Statistical Application – for historical analysis and improved trading decisions, and Account MetriX – a spark tool for detailed account analytics.

An impressive aspect of FTMO is its commitment to continually enhancing its platform with innovative features and tools, thereby demonstrating its focus on delivering cutting-edge solutions to its traders. They also offer an excellent support team to ensure a seamless trading experience.

- CEO: Otakar Suffner

- Founded: 2015

- Features: Flexible funding program, competitive profit split, multiple useful proprietary tools, and excellent support team.

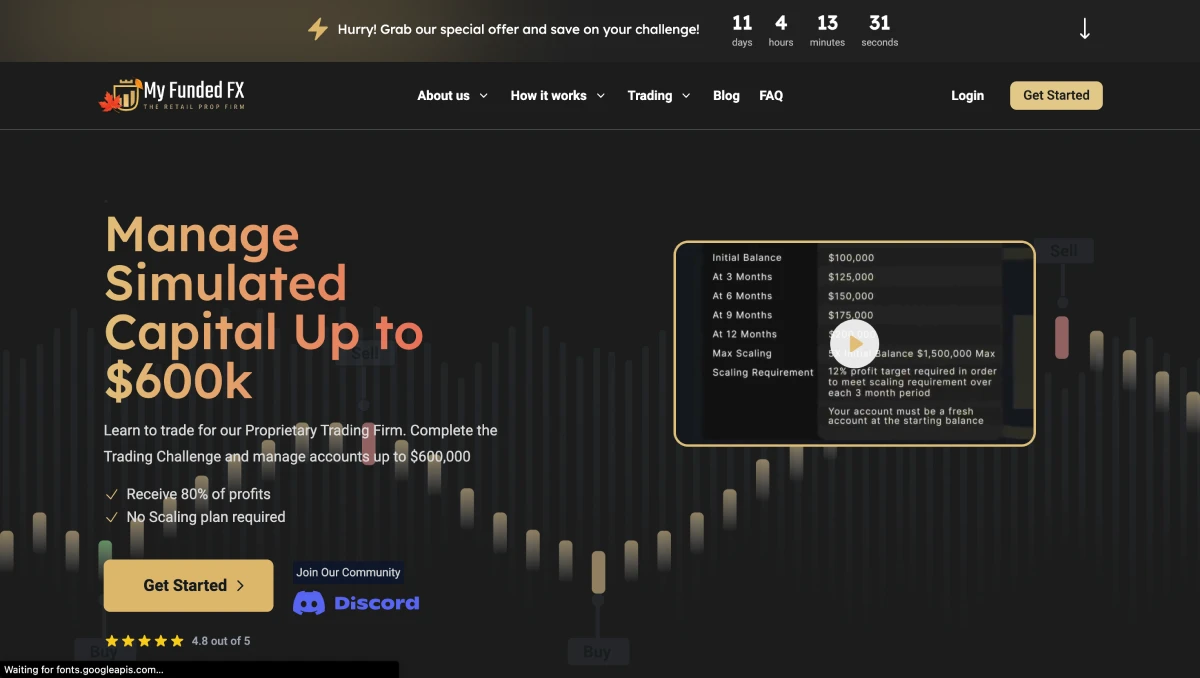

MyFundedFX is yet another key player in the arena of CFD prop trading. Their commitment to providing a supportive platform for traders to reach their maximum potential is exemplary. MyFundedFX offers an intuitive and thoroughly developed platform that is tailored to enable smooth navigation through the volatile trading marketplace.

Standing out for its straightforwardness, MyFundedFX has managed to instill confidence among clients with their fair and transparent profit distribution system. Profits are shared at a competitive rate of up to 85%, with a simplified process that removes any potential complications.

In addition to this, MyFundedFX proffers a wide range of trading options, including forex, commodities, indices, and additional CFDs. They are committed to every trader’s learning and growth, offering an exhaustive set of educational resources that keep you updated about the latest market happenings.

- CEO: Matt Leech

- Founded: October 11, 2022

- Features: Offers substantial simulated capital for practice, a range of funding packages up to $1.5 million, and features a motivational public leaderboard for trader performance tracking.

The Funded Trader, a dynamic force in the world of CFD proprietary trading, has carved a niche with its innovative and flexible funding models. Launched in 2021, this Texas-based firm is recognized for its adaptability to various trading styles and commitment to nurturing trading expertise.

With its unique profit-sharing approach, The Funded Trader offers traders a substantial portion of profits, beginning at 80% and potentially rising to 90% under certain conditions. This strategy aligns with the firm’s focus on empowering traders through equitable financial incentives.

Apart from providing diverse market access, including Forex, Cryptocurrencies, and Commodities, The Funded Trader is also known for its robust challenge-based evaluation system. These challenges are designed to cater to a variety of trader skill sets and preferences, further enhancing its appeal.

- CEO: Angelo Ciaramello

- Founded: 2021

- Features: Offers up to $1.5 million in capital through scaling, a variety of trading challenges, and a strong emphasis on trader community and support.

FundedNext, established in March 2022 by Abdullah Jayed, has quickly risen as a noteworthy proprietary trading firm in the digital and retail trading sphere. With headquarters in the UAE and additional offices in the USA, UK, and Bangladesh, FundedNext provides starting capital up to $200,000, scaling up to $4 million for proficient traders.

Catering to both novice and experienced traders, FundedNext offers four distinct funding models – Two-step Stellar, One-step Stellar, Evaluation, and Express – each tailored to different trading strategies and experience levels. Traders benefit from a high profit-sharing model, keeping 80% to 90% of profits earned in partnership with Eightcap, ensuring a sophisticated and easy-to-navigate platform.

FundedNext stands out for its quick account access, realistic profit targets, low commissions, and competitive spreads, supporting various trading styles like scalping and exotic pair trading. Its leverage of up to 1:100 offers flexibility for traders to manage their risks effectively. Additionally, FundedNext provides an Android app for on-the-go account management and hosts a vibrant Discord community for idea exchange and learning.

The firm’s four main account types include:

- Evaluation Model: A two-phase challenge with a 10% profit target in the first phase and a 5% profit target in the second phase, offering up to 90% profit split.

- Express Model: Streamlined evaluations with a 25% profit target, offering scaling plans and up to 90% profit share.

- Stellar (1-Step) Model: A single challenge phase requiring a 10% profit target, leading to 80-90% profit sharing.

- Stellar (2-Step) Model: Two challenge phases with an 8% and then 5% profit target, potentially increasing the account balance through scaling plans.

FundedNext’s vision is to empower traders globally, offering them substantial capital and opportunities to grow their trading careers through innovative and trader-friendly models

- CEO: Abdullah Jayed

- Founded: March 2022

- Features: Offers up to $4 million in trading capital, offering 80% to 90% of profits, Partnership with Eightcap.

The Trading Pit, an award-winning proprietary trading firm, offers a platform for traders to showcase their skills and access a wide range of financial instruments, with funding power up to $5 million. It’s designed to nurture and elevate skilled traders, providing an uncomplicated trading environment and support for various trading styles including High-Frequency Trading and news trading.

The firm operates on a challenge-based structure with different tiers like Lite, Standard, and Executive, catering to diverse trading preferences.

- CEO: Thomas Heyden

- Founded: 2021

- Features: Up to $5 million in funding, Profit split up to 80%, Trading opportunities in CFDs, futures

The5ers Overview: The5ers is a forex proprietary trading fund that stands out in the trading community for its unique approach. Founded by Gil Ben Hur in 2016, it was created to address the challenges traders face due to insufficient capital. The firm provides traders with the capital they need to trade effectively, offering a platform for growth and success in the forex market. The5ers operates with a clear focus on supporting traders throughout their career, providing a fair and transparent trading environment.

Features and Services: The firm is known for its flexible trading conditions, including allowing overnight and weekend holding for forex and metals, and permitting news and algo trading. They offer low commissions, tight variable spreads, and high-quality market execution using the MetaTrader 5 platform. The5ers’ funding program is particularly noteworthy, starting traders with real money accounts and offering growth milestones that are achievable, with each milestone providing more capital and greater earning potential.

Community and Support: The5ers has developed a strong community of traders and offers exceptional support. Their educational resources and customer service are highly regarded in the trading community. The firm’s commitment to ethics and trader success is evident in their operations and the positive feedback they receive from their traders.

- CEO: Gil Ben Hur

- Founded: 2016

- Features: Over $4 million funded to traders, MetaTrader 5 platform, low commission, tight spreads, supportive community, and growth-oriented funding program.

SurgeTrader Overview: SurgeTrader stands out as a prop trading firm that empowers traders by funding them with substantial capital. The firm’s approach is centered around enabling traders to use their discipline and skills to trade with the firm’s capital, offering a clear path to financial rewards. Traders can earn up to 90% of their profits and have the opportunity to scale their trading from $25K up to $1 million. SurgeTrader emphasizes the importance of consistent and responsible trading, providing a platform where skilled traders can thrive.

Features and Services: One of the key features of SurgeTrader is the absence of minimum trading days and a 30-day assessment period, which offers flexibility to traders. The firm provides a straightforward process for traders to get paid on their profits, emphasizing ease of use and efficiency. SurgeTrader’s technology and trading rules are designed to support the success of their traders, with a focus on maximizing the potential of each individual’s trading strategy.

Community and Support: SurgeTrader, based in Naples, Florida, is committed to supporting its community of traders. The firm offers various resources, including educational blogs and trading resources, to assist traders in their journey. The emphasis on mastering emotions and understanding the psychology of trading is a testament to SurgeTrader’s dedication to the holistic development of its traders.

- Ceo: Jana Seaman

- Founded: June 3, 2021

- Features: Funding up to $1 million, up to 90% profit share, no minimum trading days, flexible trading rules, comprehensive support and educational resources.

Bespoke Funding Program Overview: Based in London, the Bespoke Funding Program is a part of Bespoke Funding, a proprietary trading firm that collaborates with Eightcap as their exclusive broker. This program is unique in its approach, offering traders the opportunity to trade in forex, commodities, indices, and cryptocurrencies with accounts up to $500,000.

The program is designed to nurture hidden talent within the prop trading sector, with potential allocations reaching as high as $4,000,000. Traders can earn a profit share of up to 80%, highlighting the firm’s commitment to rewarding successful trading.

Features and Services: The Bespoke Funding Program offers a Classic Challenge account that evaluates traders over two phases, providing conditions and rewards that are attractive to a wide range of traders. The program allows for leverage up to 60 times, amplifying potential profits. Notably, there are no profit targets once a trader has a funded account, but they must adhere to a 5% daily drawdown and a 10% maximum loss rule.

The payout structure is based on an 80% profit split, and traders can request their first payout 14 days after placing the first trade on their funded account, with subsequent payouts available on a bi-weekly basis.

Community and Support: The Bespoke Funding Program is suitable for a variety of traders, including beginners and more experienced day and swing traders. The program’s structure, including balance-based drawdown and flexible challenge structures, provides a conducive environment for learning and growth. The firm’s commitment to supporting its traders is evident in its flexible policies and the provision of resources for trader development.

- Ceo: Zak Wilding and Lewis Kaler

- Founded: September 26, 2022

- Features: Trading in forex, commodities, indices, and cryptocurrencies, accounts up to $500,000, potential allocations up to $4,000,000, up to 80% profit share, leverage up to 60 times, no profit targets for funded accounts, balance-based drawdown, flexible challenge structures.

City Traders Imperium Overview: CTI has established itself as a significant player in the world of proprietary trading. The firm provides professional skill-assessment services and offers a variety of funding programs for traders. These programs are designed to assess and enhance the professional skill level of traders, allowing them to perform under specific program guidelines and objectives.

CTI operates within a simulated trading environment, where platforms mirror real trading activities but do not engage with genuine money or assets.

Features and Services: City Traders Imperium offers a Direct Funding Program, which is a no-evaluation prop firm model. This model allows traders to access funding without undergoing the traditional evaluation process. The firm emphasizes the importance of thorough preparation and study of the requirements of the funding programs before signing up. CTI’s services are not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Community and Support: The firm has garnered positive reviews from its clients, indicating a high level of satisfaction with its services. Traders appreciate the firm’s leverage and rules, which are seen as advantageous for trading safety. CTI is also noted for its fast payouts and enthusiastic support team, with additional support available through platforms like Discord.

- Ceo: Daniel Martin

- Founded: 2018

- Features: Professional skill-assessment services, Direct Funding Program, simulated trading environment, no-evaluation prop firm model, emphasis on trader preparation and study.

True Forex Funds Overview: True Forex Funds distinguishes itself in the prop trading industry by providing state-of-the-art technology and unparalleled opportunities for both seasoned day traders and beginners. The firm embarked on its journey with a mission to build the most transparent model in prop trading, leveraging its deep-rooted understanding of the forex world. It has handpicked best-in-class technology solutions to sustain its innovative approach.

The firm is committed to supporting its traders, helping them overcome financial limitations, and providing access to high-quality trading conditions typically exclusive to large institutions. In 2023, True Forex Funds introduced a $2.5 million scaling-up plan, One Phase Evaluation Process, Timeless Funding, and Quick Funding program, in addition to the traditional Two Phase Funding.

Features and Services: True Forex Funds offers a One Phase Funding challenge, designed to provide a quicker and smarter path to becoming a fully funded trader. This challenge is available with a single payment starting from €89, and traders can become fully funded by passing just one challenge. The firm has streamlined the evaluation process to save time and set lower targets to leverage traders’ motivation for success. The One Phase Funding costs the same for all account sizes as the similar-sized Two Phase Challenge.

Community and Support: The firm has received positive reviews from its clients, indicating a high level of satisfaction with its services. Traders appreciate the firm’s leverage and rules, which are seen as advantageous for trading safety. True Forex Funds is also noted for its fast payouts and enthusiastic support team, with additional support available through platforms like Discord.

- Ceo: Richard Nagy

- Funded: October 20, 2021

- Features: State-of-the-art technology, One Phase Evaluation Process, Timeless Funding, Quick Funding program, streamlined evaluation process, lower targets for One Phase Funding, same pricing structures for all account sizes.

Conclusion

What are CFD Prop Firms?

CFD Prop Firms are specialized financial entities that allow individuals to speculate on the price movements of various financial markets such as forex, indices, shares, and commodities without owning the actual underlying assets.

How does one get started with a CFD Prop Firm?

To begin with a CFD Prop Firm, an individual typically needs to undergo an evaluation process which often includes a set of challenges or tests designed to assess their strategic decision-making skills and market analysis capabilities in financial speculation.

What are the typical profit-sharing models?

Profit-sharing models vary among different. Generally, these firms offer a split where the individual keeps a significant portion of the profits (ranging from 80% to 90%) and the remaining percentage goes to the firm.

Can beginners participate in CFD Prop Firm activities?

Yes, beginners can participate. Many CFD Prop Firms offer educational resources, simulated capital for practice, and different levels of programs tailored to accommodate various skill sets, including those of beginners.

What are the key features to look for in a CFD Prop Firm?

Key features to consider include the size of capital allocation, the flexibility of funding programs, profit-sharing rates, additional tools and resources provided for performance enhancement, and the firm’s overall reputation and support system.

In conclusion, the world of CFD prop trading is diverse and vibrant, offering numerous opportunities for traders to leverage their skills and knowledge. Each of the top 10 firms highlighted in this blog post brings its unique strengths and offerings to the table. From FTMO‘s robust funding program and proprietary tools to True Forex Funds‘ innovative One Phase Evaluation Process, these firms are at the forefront of empowering traders.

Whether you are a seasoned trader or a novice, these firms provide a range of options, educational resources, and support systems to help you navigate the complexities of the financial markets. With their commitment to transparency, competitive profit splits, and innovative trading environments, these firms stand as pillars in the prop trading community, guiding traders towards success and profitability and beyond

Risk Warning: It’s essential to remember that trading involves risk, and the content on the ProdanAdvisor website is for general information only. The service and company website are provided on an “as-is” basis and without warranty of any kind.