Table of Contents

Understanding Backtesting in Trading

Backtesting in trading is a method of evaluating a trading strategy by running it against historical data. It’s a simulation of sorts, allowing you to see how your strategy would have performed in the past. This isn’t a guarantee of future results, of course, but it does provide valuable insight into the potential success or failure of your strategy.

The beauty of backtesting lies in its simplicity. You start by identifying a strategy – which includes selecting a financial instrument, such as a stock or forex pair, and defining the rules for entry and exit positions. Then, you apply this strategy to past market data and examine the results. It’s a bit like a time machine, allowing you to “trade” in the past to prepare for the future.

Just like any simulation, backtesting allows repeated trials. You can modify your strategy and try again, refining the approach until you achieve an acceptable level of risk and profit margin. After all, the goal is not just to make profitable trades, but to make trades that are more profitable than the level of risk you take on.

However, remember that backtesting is a tool, not a crystal ball. Past performance does not guarantee future results, and hence, any strategy, however thoroughly backtested, can fail in real-time markets. But, done properly, backtesting offers a window into the possible, giving you the chance to tweak and fine-tune your trading strategy for the best results.

Why Backtesting is Important for Traders

Have you ever played out a hypothetical scenario in your mind? Perhaps, what you’d do if you won the lottery or how you would act in an emergency? Believe it or not, this mental rehearsal is somewhat similar to the concept of backtesting in trading. But instead of considering random “what if” scenarios, traders rely on backtesting to answer a more specific question – “what would’ve happened if I had executed this particular trading strategy at a certain time in the past?”

Backtesting essentially involves the use of historical data to assess the viability of a trading strategy. Now, you might wonder – why is it so significant? Well, let’s dig into it, shall we?

The Importance of Backtesting: Detailed Analysis

- Validating Your Trading Strategy: Have you ever devised a potentially game-winning trading strategy in your head? Only to second guess your own brilliance later on? Here’s where backtesting comes into play. It lets you put your strategy to test on past market dynamics, eventually providing a statistical outcome of how your strategy would have fared.

- Sharpening Your Skills: Like any other skill, trading requires practice. However, you wouldn’t probably want to stake your hard-earned money while you’re still honing your trading skills. That’s where backtesting becomes particularly useful. Not only can it help sharpen your trading skills, but it can also do so without putting your capital at risk.

- Understanding Market Dynamics: Even the most experienced traders will tell you that the market often behaves in unpredictable ways. However, by observing how your strategies perform during different market conditions, backtesting can help you comprehend these market dynamics better.

- Improving Your Strategy: Lastly, backtesting helps you continuously refine your trading strategy. By identifying the weaknesses of your strategy, you can tweak it until you achieve desired results.

In essence, backtesting is equivalent to a dress rehearsal before the actual performance, enabling traders to fine-tune their strategies and augment their decision-making process. Mind you, backtesting does not guarantee trading success, it simply increases the likelihood of it by providing an evidence-based approach to trading. Now, isn’t that a crucial tool for traders to have in their arsenal?

Choosing the Right Software Tools for Backtesting

As an informed trader, selecting the right software tools for backtesting can significantly refine your strategy and strengthen your trading performance. Let’s explore a few notable options such as FxReplay, TradingView, and TraderEdge.

FxReplay, a web-based platform, is specifically designed for backtesting Forex strategies. Its simple interface allows you to compare your own strategies with other successful ones in the FxReplay community. Notably, it provides a feature to simulate trading on historical data, helping you comprehend how your strategy would have fared in past market conditions.

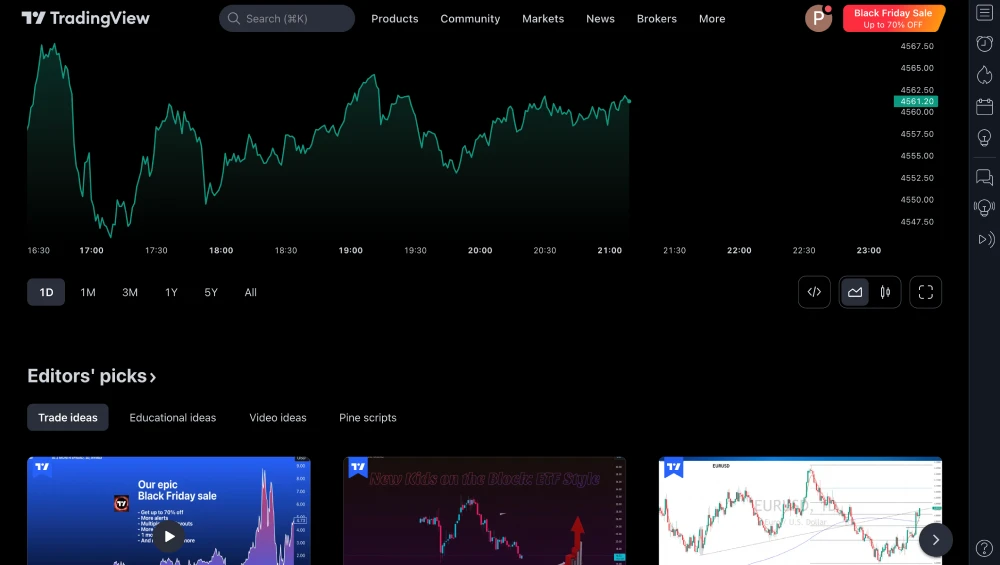

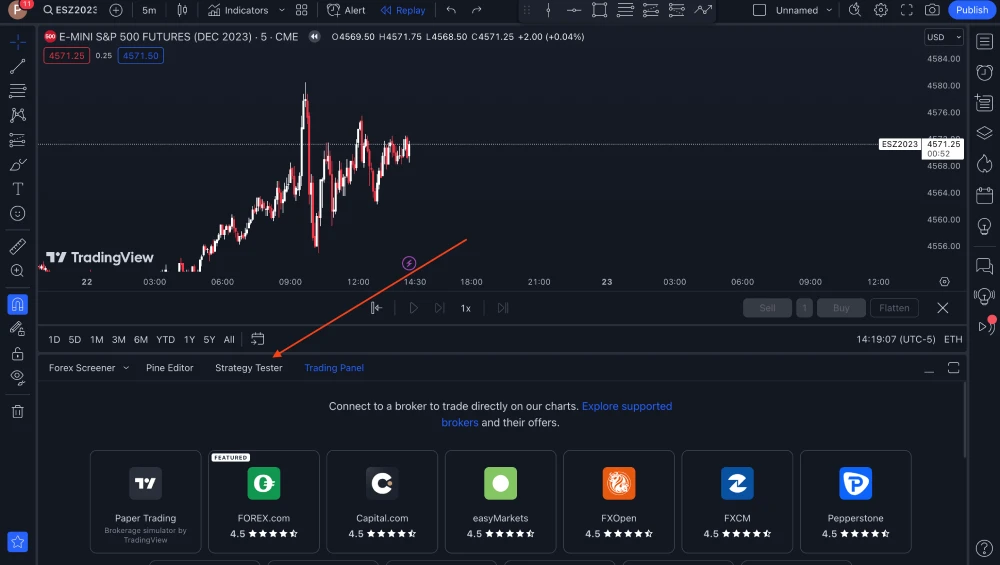

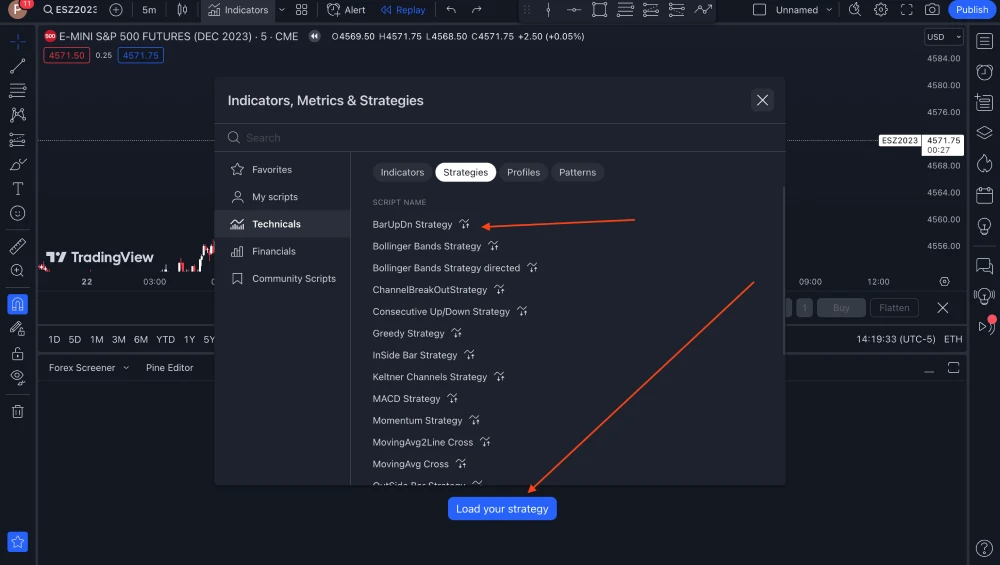

Next, let’s discuss TradingView, a versatile platform utilized by both novice and seasoned traders. This platform offers a host of features that makes it stand out, notably extensive charting tools and a built-in stock screener. The ai-powered backtesting system in TradingView empowers you to evaluate multiple strategies simultaneously, planning for a variety of market conditions. The interactive community of traders is an added bonus, allowing you to share and learn from others’ strategies and insights.

Last but not least, TraderEdge is a desktop-based application popular amongst quantitative traders. It offers advanced backtesting capabilities, including the use of complex algorithms and strategies. A standout feature is the application’s sensitivity analysis toolkit, helping you identify the variables most impacting your strategy’s success. TraderEdge’s comprehensive data analysis tools can improve your understanding of market patterns, thereby refining your trading strategy.

Remember, while each of these software tools offers a range of backtesting features, your personal trading style and needs should ultimately guide your choice.

Exploring the Features and Pricing of Top Backtesting Software

1) TradingView Backtesting Tools

| Feature | Description |

|---|---|

| Bar Replay | Manual backtesting by replaying market movements from a specific point on a chart. |

| Strategy Tester | Automated backtesting using historical data with detailed performance metrics. |

Subscription Plans and Limitations

- Free BASIC Subscription:

- Limitation: Only daily chart data available for backtesting.

- Not Included: Intraday data essential for day traders and deep backtesting.

- Paid Subscription Plans:

- Pro Plan:

- Cost: $12.95 per month.

- Features: Enhanced number of alerts and indicators per chart.

- Pro Plus Plan:

- Cost: $24.95 per month.

- Features: Additional alerts and indicators, improved customer support.

- Premium Plan:

- Cost: $49.95 per month.

- Features: All available features, including priority customer support and early access to new features.

- Note: Prices may vary based on location due to sales tax.

- Pro Plan:

Free Trial and Decision Making

- 30-Day Free Trial:

- Offer: Includes access to intraday data and other premium features.

- Purpose: Allows new users to explore and evaluate the platform’s capabilities.

Key Considerations

- Decision Making: The trial period is an excellent opportunity to assess the value of premium features for individual trading needs.

- Upgrade Potential: Users can make an informed decision about upgrading their subscription based on trial experience

2) TraderEdge: Backtesting Software Overview

| Feature | Description |

|---|---|

| Backtesting | Efficient strategy and indicator backtesting with detailed metrics like profit factor, average trades, and EdgeScore. |

| Trade Journaling | Comprehensive journaling to record and analyze trades, aiding in performance tracking over time. |

| Profit & Loss Calendar | Built-in tool for monthly and weekly performance analysis with daily notes for strategy refinement. |

| Forward Simulator | Simulation feature for assessing the performance of trading strategies. |

Pricing and Plans

- One-Time Payment Structure: All plans offer lifetime access with a single payment.

- Available Plans:

- Beginner Plan:

- Cost: $168.

- Inclusions: 5 backtests per month (500 trades), 5 saved backtests, profit & loss calendar, forward simulator.

- Pro Plan:

- Cost: $288.

- Inclusions: 10 backtests per month (1000 trades), 10 saved backtests, profit & loss calendar, forward simulator.

- Data Guru Plan:

- Cost: $528.

- Inclusions: Unlimited backtests, unlimited saved backtests, profit & loss calendar, forward simulator.

- Beginner Plan:

Key Highlights

- Efficiency: TraderEdge claims to deliver backtesting results up to 3 times faster than traditional methods.

- No Recurring Payments: One-time payment ensures no ongoing subscription fees.

- Comprehensive Features: Each plan is tailored to different levels of trading expertise and needs, with features ranging from basic to advanced.

3) FX Replay: Web-Based Backtesting Tool Overview

| Feature | Description |

|---|---|

| TradingView Charts Integration | Utilizes TradingView’s charting platform for high-quality chart analysis. |

| Easy Order Management | Facilitates straightforward management of trading orders. |

| Replay Feature | Enables review and refinement of trading strategies by replaying market scenarios. |

| Multiple Strategy Creation | Supports the creation of up to three distinct trading strategies. |

| Backtesting Sessions | Allows for up to 20 backtesting sessions to analyze strategies. |

| Indicator Support | Supports up to 5 indicators, with no custom indicator addition currently available. |

| Pairs/Instruments Access | Offers access to 14 pairs/instruments, with one pair/instrument per session. |

| Historical Intraday Data | Provides historical intraday data back to 2016 for comprehensive analysis. |

Pricing and Subscription Details

- Yearly Subscription:

- Cost: $350 annually (equates to approximately $29.17 per month).

- Inclusions: Access to all features mentioned above.

- Free Trial:

- Duration: 5-day free trial.

- Purpose: Allows users to test the full capabilities of the tool.

Additional Information

- Cancellation and Refunds: Subscriptions can be cancelled anytime with refund requests handled through customer support.

- User Experience: Designed to provide a comprehensive backtesting experience, leveraging the quality of TradingView charts.

Getting Started with Backtesting: Step-by-Step Guide

Tradingview Backtest

1) TradingView Replay

2) TradingView Strategy Tester

Fxreplay Backtest

Traderedge Backtest

1) Manual backtest

2) Automated backtest

Defining Your Backtesting Strategy and Goals

| Strategy | Goals |

|---|---|

| Moving Average Crossover | Identify ideal entry and exit points, measure effectiveness of the strategy over time. |

| MACD Divergence | Detect possible reversals, study consistency of the strategy across various market conditions. |

| RSI Oversold/Overbought | Anticipate a price movement reversal, gauge strategy’s reliability when coupled with other indicators. |

| Bollinger Bands Squeezes | Detect periods of low volatility that could precede significant price movements, check trial this strategy in different market trends. |

| Volume Weighted Average Price (VWAP) | Analyze intraday price movements, examine the practicality of this strategy with particular attention to high-volume trading periods. |

Avoiding Common Mistakes in Backtesting

When venturing into backtesting, it’s crucial to be aware of the common pitfalls that might stand in the way of your success. One common error many traders make is over-optimization. This happens when a strategy is excessively fine-tuned to perform well in historical data, but may fail to deliver in a real-world scenario. Sounds a little bewildering? Imagine setting parameters so specific that they only work for one particular scenario and nothing else. Not exactly the best approach, right?

Next, traders often fall into the trap of curve fitting. This occurs when your strategy is tailored too closely to past events, inadvertently skewing your results. Remember, just because something happened in the past, doesn’t mean it will recur in the future exactly in the same pattern.

Lastly, many traders neglect the cost of trade while backtesting. In the real world, you’ll be accounting for things like transaction fees, spread, taxes, and so on. Failing to incorporate these into your backtesting plan can lead to a stark difference between your projected and actual results.

Remember, backtesting isn’t a guaranteed passport to trading success. It’s a method that simply helps you realize the potential strengths and weaknesses of your strategy. Be mindful of these common mistakes, and you’ll be well on your way to a more accurate and meaningful back testing experience.

What is backtesting in trading?

Backtesting in trading is the process where a trading strategy or model is tested using historical market data to determine its effectiveness. It simulates the application of a strategy to past market conditions to evaluate how well it would have performed.

Why is backtesting important in trading?

Backtesting is important because it allows traders to validate their trading strategies before applying them in real-time markets. It helps in identifying the potential profitability and risk associated with a strategy, thereby reducing the likelihood of significant losses. Additionally, it aids in refining and optimizing trading strategies.

Can backtesting help improve trading strategies?

Yes, backtesting can significantly help in improving trading strategies. By analyzing the performance of a strategy under various historical market conditions, traders can identify and rectify the weaknesses in their strategies. This iterative process leads to the development of more robust and effective trading strategies.

Are there any limitations to backtesting?

There are several limitations to backtesting:Overfitting: Tailoring a strategy too closely to historical data can make it less effective in future conditions.

Changing Market Conditions: Past market performance may not accurately represent future market behavior.

Data Quality and Availability: The accuracy of backtesting is highly dependent on the quality and completeness of the historical data used.

Simplified Assumptions: Backtesting often overlooks real-market factors like transaction costs, liquidity issues, and order execution delays.

How accurate is backtesting in predicting future market performance?

While backtesting can provide valuable insights into how a trading strategy might perform, its accuracy in predicting future market performance is not guaranteed. Financial markets are complex and influenced by a myriad of unpredictable factors. Thus, a strategy that was successful in the past might not necessarily yield the same results in the future. It’s essential for traders to use backtesting as one of many tools in their decision-making process, recognizing its limitations and the inherent unpredictability of markets.

Conclusion

Backtesting in trading provides a great foundation for evaluating the efficiency and viability of trading strategies. After learning the ins and outs of backtesting, you’ve probably realized how essential it is to have the right software tools. Simply put, the proper execution of backtesting is impossible without the right resources.

Fortunately, many software tools are readily available to assist you, which we elucidated in ‘Choosing the Right Software Tools for Backtesting‘ and ‘Exploring the Features and Pricing of Top Backtesting Software’ sections. From commercial products to free, open-source options, these platforms integrate state-of-the-art technology to simplify the backtesting process.

However, even with advanced tools, the effectiveness of backtesting largely depends on your strategy and how you employ it. Your backtesting strategy and goals should be clearly defined, preferably based on realistic market conditions. As we’ve mentioned, avoiding common mistakes, like the problem of overfitting and ignoring out-of-sample testing, is also indispensable to the successful execution of backtesting.

Remember, however effective, backtesting is merely a simulation, not a prophecy of actual trading results. Keep that in mind while making decisions based on its outcomes.

The landscape of backtesting is constantly evolving, spearheading the adoption of innovative techniques like machine learning. In the ‘The Future of Backtesting: Trends and Innovations’ section, we underscored the importance of staying updated with these advancements to harness their potential benefits.

To wrap up this topic, back testing is a fruitful exercise that provides traders an edge, offering valuable insights into potential risks and opportunities. As long as you remain conscious of its limitations, use reliable software tools, and practice sound strategies, backtesting can be a powerful ally in your trading journey.

Think backtesting, think winning trades!