Table of Contents

Proprietary trading, also known as ‘prop trading,’ is a practice conducted by banks and financial institutions. It involves the institutions making trades — stocks, bonds, commodities, currencies, or other financial instruments — directly from their own accounts rather than through client orders. This type of trading is done with the intent of making a direct profit from the trade, rather than earning commission from client trades. As a result, proprietary trading can offer high rewards, but it’s not without its potential risks.

How does Proprietary Trading work?

Proprietary trading typically involves advanced strategies, such as arbitrage (buying and selling the same security in different markets to exploit pricing differences), swing trading (buying and selling securities within short timeframes to catch shifts in momentum), and index fund rebalancing (trading to re-align holdings with benchmark indices).

The Role of Proprietary Trading Firms

Proprietary trading firms generally provide capital to traders, allowing them to trade without risking their own money. This can be a major advantage for traders without the capital to back their trades, or those looking to lower their personal risk. The firm makes money by taking a cut of the trader’s profits.

“Remember, proprietary trading carries significant risks along with its potential rewards. It’s important to understand and carefully consider these risks before diving in.”

Traders at proprietary firms are typically not employees but rather contractors. This brings a degree of flexibility, as traders can set their own hours and working conditions to some extent. However, there are also downsides, such as a lack of benefits and job security compared with traditional employment.

Let’s delve deeper into the potential risks and rewards of dealing with proprietary trading firms.

Understanding Proprietary Trading: A Comprehensive Guide

First and foremost, let’s delve into the fundamental concept of proprietary trading. Proprietary trading, commonly known as prop trading, refers to a situation where a financial firm trades stocks, bonds, currencies, commodities, derivatives, or other financial instruments with its own funds, instead of using clients’ money, for the intent of making a direct profit rather than earning commission dollars.

Turning to its functionality, it’s worth noting that proprietary trading can take place in a variety of ways. This includes agency trading, market making, and arbitrage. Taking a complex financial environment into account, improvisational skills combined with a robust understanding of market dynamics are critical for success.

- Agency Trading: This implies when a firm acts as an agent, buying and selling to fulfill client orders. However, unlike traditional agency trading, proprietary traders use the company’s money to fulfill orders.

- Market Making: This forms a vital part of proprietary trading. In this, the prop traders look to earn the spread between the buying and selling price of a financial instrument by standing ready to buy or sell.

- Arbitrage: A critical element in prop trading, firms exploit pricing inefficiencies across different markets or products, buying a cheaper security, and simultaneously selling it at a higher price elsewhere.

You also must be aware that not all trading is the same. For instance, the nature of day trading (where positions are closed out within the same trading day) differs from that of swing trading (positions held for a period of days to weeks), or high-frequency trading (a subtype of algorithmic trading, where large numbers of orders are sent in and out of the market at high speed).

While this might seem a bit overwhelming at first, keep in mind that each approach has its unique pros and cons. What really matters is finding a method that best lines up with your risk tolerance, financial goals, and overall investment strategy.

The Pros and Cons of Proprietary Trading: Analyzing the Potential Benefits and Drawbacks

Here we are, ready to dissect the pros and cons of proprietary trading. Like any financial venture, it comes with its fair share of potential gains and pitfalls. Your duty, as an informed reader, is to weigh these factors and decide whether this path suits your financial goals or not. So, let’s get started.

Potential Benefits of Proprietary Trading

First off, let’s delve into the brighter side – the potential benefits.

- Access to greater capital: When working with proprietary trading firms, you’re not limited to your own finances. The firm will typically provide you with more capital than you’d have as an individual trader. This amplifies your trading power.

- Absence of personal risk: If your trades go sour, you won’t be personally on the hook for the losses. The risk is borne by the firm. This gives you breathing room to take bolder, more strategic risks.

- High earning potential: Proprietary trading can be incredibly lucrative. When trades are successful, the profits can be significant. If you’re an adept trader, this can be a gold mine.

- Professional growth: Proprietary trading firms often provide beneficial resources for skill enhancement and knowledge acquisition. These include training programs, mentorship, and access to advanced trading tools.

Potential Drawbacks of Proprietary Trading

Now for the potential drawbacks, let’s go over some of the challenges traders often face:

- High-pressure environment: Proprietary trading can be stressful. Firms rely on their traders for profitability, and this pressure can lead to demanding workloads and long hours.

- Limited control over investment decisions: Trading strategies and decisions may be controlled by the firm’s overall trading plan. This can stifle your creative trading strategies and limit your autonomy.

- The need for consistent profitability: There is an underpinning expectation for consistent profitability in proprietary trading. If you cannot generate steady profits, your future with the firm could be on shaky ground.

- Split profits: While the profit potential is high, remember that you’ll have to share these with the firm. Your personal cut may not be as high as you envision.

In conclusion, proprietary trading can be a rewarding venture filled with opportunities, but it also comes with potential challenges. It’s essential that you measure these aspects against your risk tolerance, trading skills, and career goals before deciding if this path is right for you.

Maximizing the Rewards: Strategies for Success in Proprietary Trading

As an intuitive and ambitious trader, you’re probably interested in exploring ways to maximize the gains from your proprietary trading endeavors. Well, you’re in the right place. Here, we draw on expert advice and industry best practices to present an engaging guide to help you succeed in this dynamic field.

Firstly, let’s establish something crucial – there are no shortcuts or guaranteed paths to success in proprietary trading. It’s a world characterized by its volatility, complexity, and sharp learning curve. But while there are significant challenges, it’s also a field filled with potential rewards for those who can master it. Let’s dig into some strategies for thriving in proprietary trading.

1. Building a solid foundation in financial markets

Knowledge is power in any trading environment. It’s essential to cultivate a strong understanding of everything from the mechanics of the trading world to the specifics of global financial markets. This includes diving deep into the ins and outs of stocks, bonds, futures, options, and other securities. Expertise in these areas can be a potent weapon in your proprietary trading arsenal.

2. Developing a robust trading strategy

Successful proprietary trading isn’t just about understanding markets or securities. It requires a data-driven, calculated approach. Crafting your unique, comprehensive trading strategy, complete with clear goals, risk management practices, and performance indicators, is crucial. You should be able to simulate, test, analyze, and refine this strategy continually.

3. Cultivating emotional resilience

Emotional resilience is almost as crucial to proprietary trading success as financial acumen. The capacity to handle stress, maintain perspective, operate calmly under pressure, and bounce back from losses, helps maintain rational and informed decision-making in the face of market volatility.

4. Embracing continual learning

In the world of proprietary trading, the only constant is change. Market trends shift. Financial instruments evolve. Regulatory landscapes transform. By committing to a cycle of continuous education, adaptability, and resilience, you ensure you stay at the forefront of this fast-paced industry.

Implementing these strategies into your proprietary trading approach can offer a significant advantage. Remember, rewards are attained by blending knowledge, skill, patience, and emotional control. Keep your eyes on the prize and stay disciplined in your practice, and you might find that proprietary trading offers an exhilarating and rewarding journey.

Risk Management in Proprietary Trading: Balancing the Potential Losses and Gains

Effective risk management is the keystone of any successful proprietary trading venture. Let’s dig deeper into this subject to fully understand its significance.

Proprietary trading can be high risk, high reward, making the art of balancing potential losses and gains critically important. The right risk management strategies not only keep your losses in check but also allow for sizeable gains.

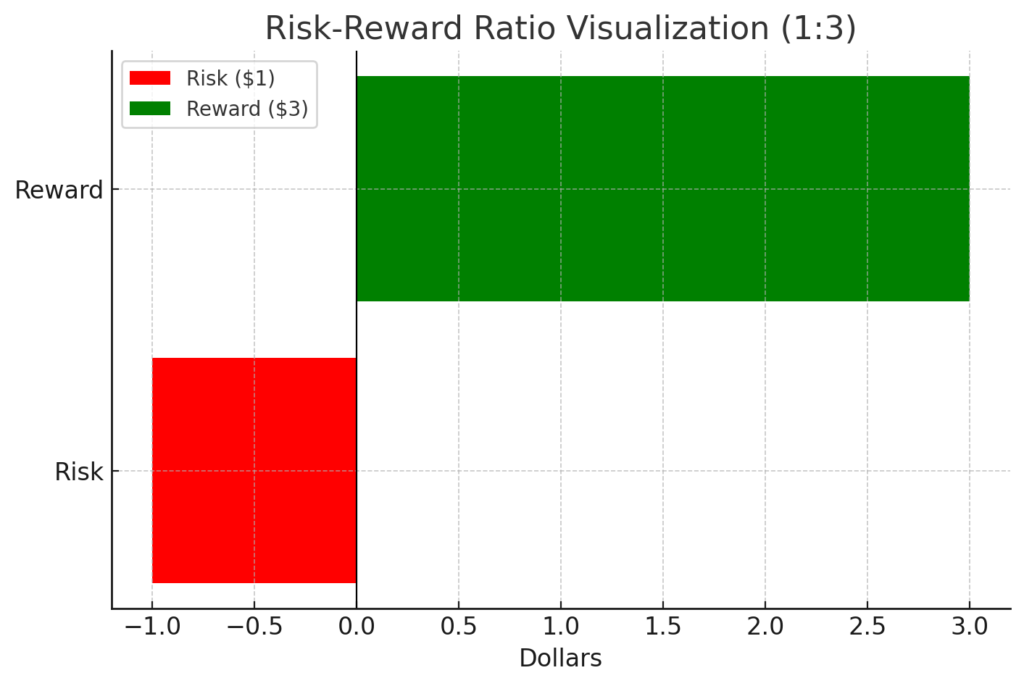

The Principle of Risk-Reward Ratio

At the heart of risk management is understanding the risk-reward ratio. The risk-reward ratio is a measure of how much potential profit an investment opportunity offers for every dollar of risk. Let’s say a trader has a risk-reward ratio of 1:3; it means the trader is willing to risk $1 to make $3.

Implementing Practical Risk Management Measures

Beyond understanding the risk-reward ratio, there are other practical risk management measures you can implement:

Firstly, Setting Stop-loss Orders: is an important practice. This involves specifying a price at which your position will automatically be closed if the market turns against it. It’s like having a safety net, ensuring you don’t sink with a loss-making position.

Next, Diversifying your Trades: You’re less likely to suffer significant losses if your trades are not all in one basket. By spreading your trades across different assets, you increase chances of making some profit even if one or more of your trades go south.

You should also Be Aware of Market Conditions: staying abreast of market trends, news, and updates can you help to make informed decisions and possibly forestall potential losses. For instance, a negative news event concerning a particular company could trigger a market sell-off affecting that company’s stocks.

Lastly, don’t underestimate the power of Maintaining a Trading Journal: it may seem mundane, but keeping a record of your trades – both successful and unsuccessful, can guide future decisions. It helps you identify the strategies that works and those that don’t.

- Stop-loss Orders helps control potential losses.

- Diversifying your trades offers a hedge against significant loss.

- Staying updated on Market Conditions aids informed decision-making.

- Maintaining a Trading Journal can guide future trading decisions.

Remember: your success as a proprietary trader largely depends on how effectively you can manage risk. While rewards can be enticing, it is essential that you always have a risk management plan in place, and these practical measures can form part of that plan.

Finding the Right Fit: Choosing the Best Proprietary Trading Firm for You

Choosing the best proprietary trading firm for you means finding one that aligns with your financial goals and risk appetite. It’s not simply about identifying the firm offering the highest returns; it’s also about finding a firm whose values align with yours and whose risk management practices are robust.

Here are some key factors to consider when deciding on the right proprietary trading firm for you:

- Culture and Environment: Are their values and trading philosophy in sync with yours? A firm’s culture can greatly influence your experience and success. You want to be in an environment where you feel motivated and supported.

- Training and Development: Does the firm offer training opportunities or support for ongoing education? Continuous learning is crucial in proprietary trading, and being with a firm that supports this can make a big impact.

- Technology: The software, platforms, and tools the firm uses can impact your trading. Make sure they use state-of-the-art technology that enables fast and efficient trading.

- Risk Management Practices: Understanding the firm’s approach to risk management is key. This ties back directly to the overall stability and security of your investments with the firm. Good firms have a well-articulated risk management policy.

- Fees: Make sure to understand the fee structure, as this can significantly affect your returns. Some firms might be more transparent with their fees than others. Always ask to clarify if there’s something you don’t understand.

You should also do your due diligence about the firm’s reputation in the industry. Check their track record, their financial strength, and client testimonials. Do not hesitate to ask questions during your interactions with them and trust your gut feelings.

What are some key factors to consider when evaluating a proprietary trading firm’s reputation?

Key factors include their track record, their financial strength, and client testimonials.

Can initial interactions with the firm provide helpful insights?

Yes, one should not hesitate to ask questions during interactions with the firm and trust their gut feelings about the firm’s integrity and transparency.

Is financial strength of the firm a critical metric to consider?

Yes, the financial strength of a proprietary trading firm is vital as it paints a picture of their reliability and stability.

Are client testimonials relevant in assessing a proprietary trading firm?

Yes, client testimonials can often provide valuable insights into the firm’s customer service and operational efficiency.

Should I always trust my gut feeling when choosing a proprietary trading firm?

While gut feelings can act as a guide, it’s essential to base your decision on concrete factors such as the firm’s track record, financial stability, and client satisfaction.

Conclusion

In conclusion, aligning with a proprietary trading firm that offers the right support, the right culture, and solid risk management practices can help you navigate this invigorating yet complex landscape successfully.